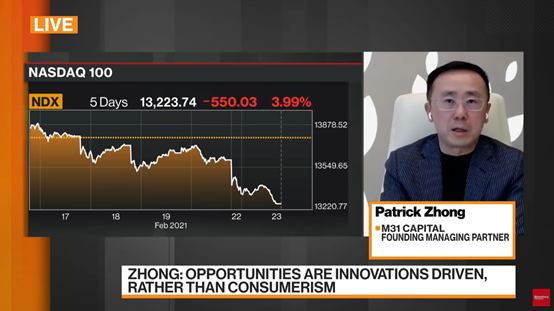

On February 23, Patrick Zhong, Founding Managing Partner of M31 Capital, was interviewed by Bloomberg News in the “Bloomberg Markets: China Open” section,during which he shared views on early-stage investment in the technology sector and M31 Capital’s investment strategy. Below is the complete transcript of the interview.

Q: In terms of valuations then, is this the turning point for the tech sector?

A: Tom, good to be with you and I have been around for a little while, having gone through a couple of cycles in my life. Normally, with a typical cycle, it will run through its full course within about 10 years. This time is so extraordinary and there is so much liquidity being injected into the system. This morning, Ray Dalio wrote a piece, and he is saying by his measures and with all this metrics and we are in a relatively frothy area, he is now claiming that it is in the bubble area. But I think directionally no tree can grow into the sky. With bond yield picking up a little bit, the market may start to sell off, and this is the period we are in. For us, we are very much looking into the fundamentals. We are lucky, we are early-stage investors investing in companies in Series B and onward. It is not just about the growth itself. We are looking for the best (entry point) within the entire growth horizon of a company. A lot of interesting companies we are looking at are just going to grow for quite a long time at a high rate, and we can capture that value at earlier stage.

Q: Okay and you have recently raised about 450 million U.S. dollars for a fund and an additional fund at M31 Capital. How are you deploying that capital, Patrick?

A: Yes, I think it is important to put everything into context a little bit. I think I can offer you two. First of all, China gained about 1.1% of global share of GDP last year and the first time being number two in the world that China has reached about 75% of American economy. Previously, Japan was number two and reached just about 50% of American economy. What I am trying to say here is that the Chinese economy is large enough to really stimulate further growth (in itself). This time is no longer just about consumption, it is about innovations. When I returned to China in 2009, I remember I was asking this question to the secretary treasury Timothy Geithner. I asked what is going to be the driving (force) of American (economic) growth after the financial crisis. His answer was very profound to me and that it was about every 10 years, a quarter of the American economy is new. This (level of innovation) is exactly what we are seeing right now (in China). The reason I founded M31 Capital was the belief that the structural opportunities within the Chinese early-stage (investments) are becoming very much innovation-driven, not just consumer-driven. So, this is where I am going to deploy our capital. We hire people who are domain experts before they join us which we inherit the Wellington Model, that is everybody is an expert (in their domain), and we share knowledge tremendously across different themes, across different technologies, we compare notes all the time. I believe the convergence of all the trends and all the technologies is going to be the most important theme for us to spend time on. Companies like ByteDance are not just about media or internet, it is about a lot of other things as well. They are our best AI idea for instance.

Q: Understood. Patrick, I like what you said earlier that no tree can actually grow to the sky, but also you are now outlining that there is still tremendous growth across many other parts of the internet space or tech space in China. The recent development these last couple of months has been the onslaught of regulation I mentioned and maybe some other names from the time that you went back to China in 2009. Do you think people like you in the private markets are starting to rethink your projections of how big these companies can grow, because they might be too big for the government? What are your thoughts on that?

A: For everyone who has been around long enough and especially (those) putting money to work, in the U.S., in Europe and in Japan, we all have to struggle with this when companies grow so large. What would the regulators do to you? Certainly, they want to encourage competition, so, when someone gets too large, that is going to cast a shadow on competitive landscape. So, this is something being an investor you have to think about all the time, and this is not just specific to China, this is a part of the game of investing in larger companies. You have to understand the risk. Risk is not just about revenue (potential). The risk (can manifest) in many other ways as well.

Q: Understood. Now, I want to bring in what Tom was mentioning valuations earlier, I cannot remember the last time the exit market, public markets that was this hot whether you are looking at Shenzhen, the starboard or Hong Kong, I am wondering what the conversation is between you and the founders. Is this pushing more and more people to list a little bit early and do you think that is a good or a bad thing?

A: There are two types of companies. There is one type of company, they are there just wanting to increase the value and investors want returns. There is another type, they are there to build long-term businesses with the founders who care less about where the market is today, because they (know they) are building tremendous value into their businesses (everyday). This is the type of companies we want to be with, and we do not want to be with the companies who are just looking at everything in an optimistic fashion. Such is the distinction between great companies and less great companies.

Q: Patrick, before we let you go, Kuai Shou of course is listed successfully in Hong Kong, one of their main competitors ByteDance which of course owns Douyin here in China, Tik-Tok in the U.S., and you have invested in that company. Would you like to see ByteDance IPO and what kind of time frame would you be looking at?

A: This is where I do not have a comment. By the way, I think the founder himself is a tremendously sophisticated leader. He has navigated through such amount of complexity last year with reasonable success. On the product front, he is building a tremendous suite of products and playing the game at a different level. I think ByteDance is a company to watch, this is about a true global technology leader, not just about a stock.