From the waterfront halls of Miami to the Bavarian lakeside of Tegernsee, and on to the innovation corridors of Singapore and Kuala Lumpur, Patrick Zhong, Founding Managing Partner of M31 Capital, was invited to participate in a series of the world’s most influential investment gatherings in the first half of 2025. Each engagement—whether a closed-door session with technology pioneers, a European summit on capital resilience, or an Asia-Pacific dialogue on deep tech—provided vantage points on where global capital is moving, which technologies are nearing commercial inflection, and how long-term investors can position ahead of consensus.

United States | Positioning for structural growth

FII PRIORITY Summit, Miami – In February, at one of the year’s most closely watched global investment forums, Patrick Zhong co-chaired a high-level closed-door session with Eric Schmidt, Google’s former CEO, and Richard Haass, former President of the Council on Foreign Relations. The room brought together 50 CEOs and leading investors from top American firms to assess market shifts and investment priorities in an unpredictable environment.

In an exclusive interview with FII TV, described artificial intelligence as a structural force reshaping how economic value is created and captured. The most compelling opportunities, he argued, will emerge where expertise, talent and innovation capacity are connected across borders to create complementary strengths.

Click below to watch the full FII TV interview.

This year’s FII PRIORITY Summit brought together more than 1,000 participants from the finance, government, and technology sectors. U.S. President Donald Trump delivered his first in-person public address since taking office. Other attendees included Elon Musk, head of the U.S. Office of Government Efficiency; H.E. Yasir Al-Rumayyan, chairman of Saudi Arabia’s Public Investment Fund; Robert Kapito, president of BlackRock; Masayoshi Son, chairman of SoftBank Group; Safra Catz, CEO of Oracle; and Dara Khosrowshahi, CEO of Uber.

Milken Institute Global Conference, Beverly Hills – Three months later, at a flagship event attracting more than 5,000 participants from 80 countries, including Tony Blair, Former Prime Minister of the United Kingdom; Scott Bessent, Secretary of the U.S. Department of the Treasury; Elon Musk, Head of the U.S. Office of Government Efficiency; Rupert Murdoch, Chairman Emeritus of Fox Corporation and News Corp; Bill Ackman, CEO of Pershing Square Capital Management; Kenneth Griffin, Founder and CEO of Citadel; and Jensen Huang, CEO of NVIDIA.

Patrick Zhong was invited to joined a private discussion with a select group of senior investors and corporate leaders. The conversation ranged from frontier AI and supply-chain reinvention to the restructuring of global trade flows. The tone was forward-looking: focus less on diagnosing risks, more on building platforms and portfolios positioned for structural growth.

Europe | Innovation anchored in resilience

Unternehmertag European Business Summit, Germany –Germany’s flagship private-capital forum returned to Tegernsee in March, gathering more than 600 investors, family offices, and business leaders. Resilience dominated the agenda: how to structure portfolios to withstand supply-chain stress, energy shocks and volatile market access. Patrick Zhong suggested a shift from forecasting to fortifying—spending less time predicting shocks and more time designing portfolios and partnerships that absorb them. In practice, it implies recasting allocation frameworks to balance return targets with adaptability, favouring sectors and geographies that can withstand sudden policy, technology and demand shocks.

The line-up featured senior European figures from policy and business, among others Dalia Grybauskaitė, former president of Lithuania; Jean Asselborn, Luxembourg’s former foreign minister; Wolfgang Ischinger, chairman of the Munich Security Conference Foundation; Markus Söder, Bavaria’s minister-president; Nicola Beer, vice-president of the European Investment Bank; and Anna Wieslander, head of Nordic at the Atlantic Council.

Southeast Asia | A New Center of Gravity

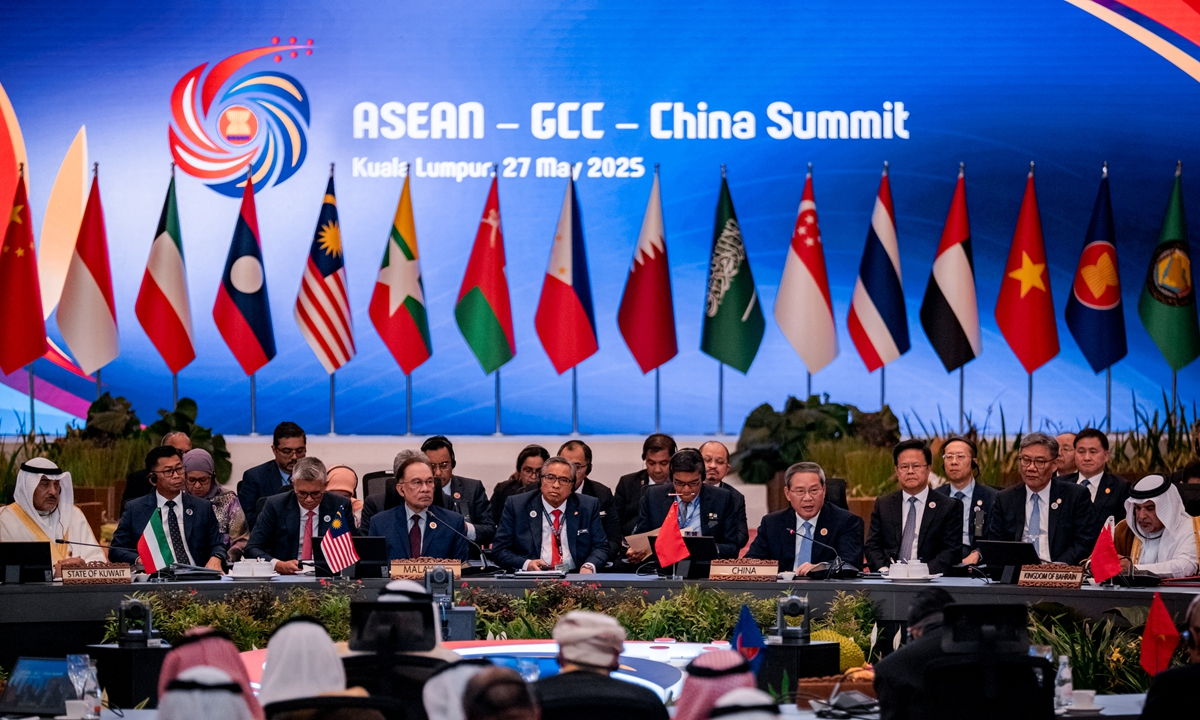

ASEAN–China–GCC Summit, Kuala Lumpur – In May, the first trilateral summit between ASEAN, China and the Gulf states put Southeast Asia at the centre of the conversation. Li Qiang, Chinese premier; Anwar Ibrahim, Malaysian prime minister; and Mishal Al-Ahmad Al-Jaber Al-Sabah, Kuwait’s crown prince, were among the leaders in attendance.

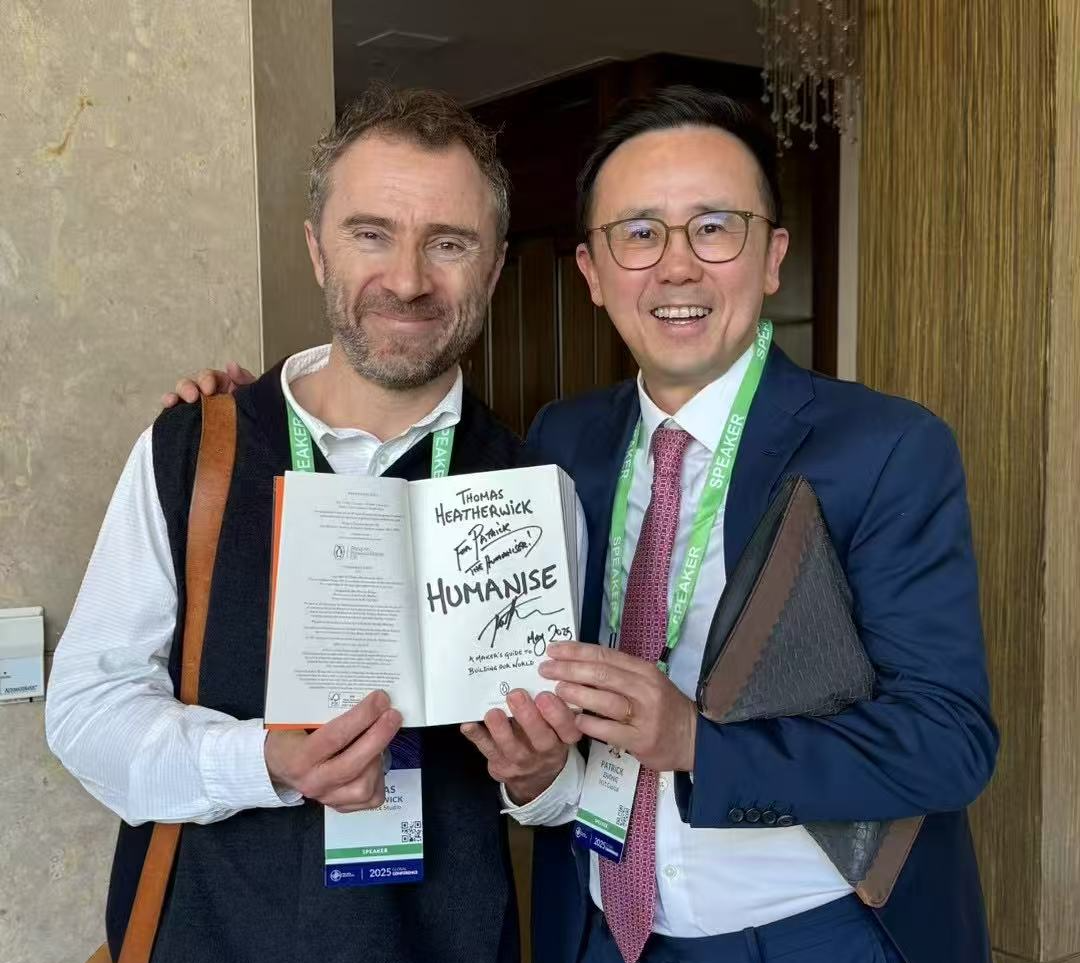

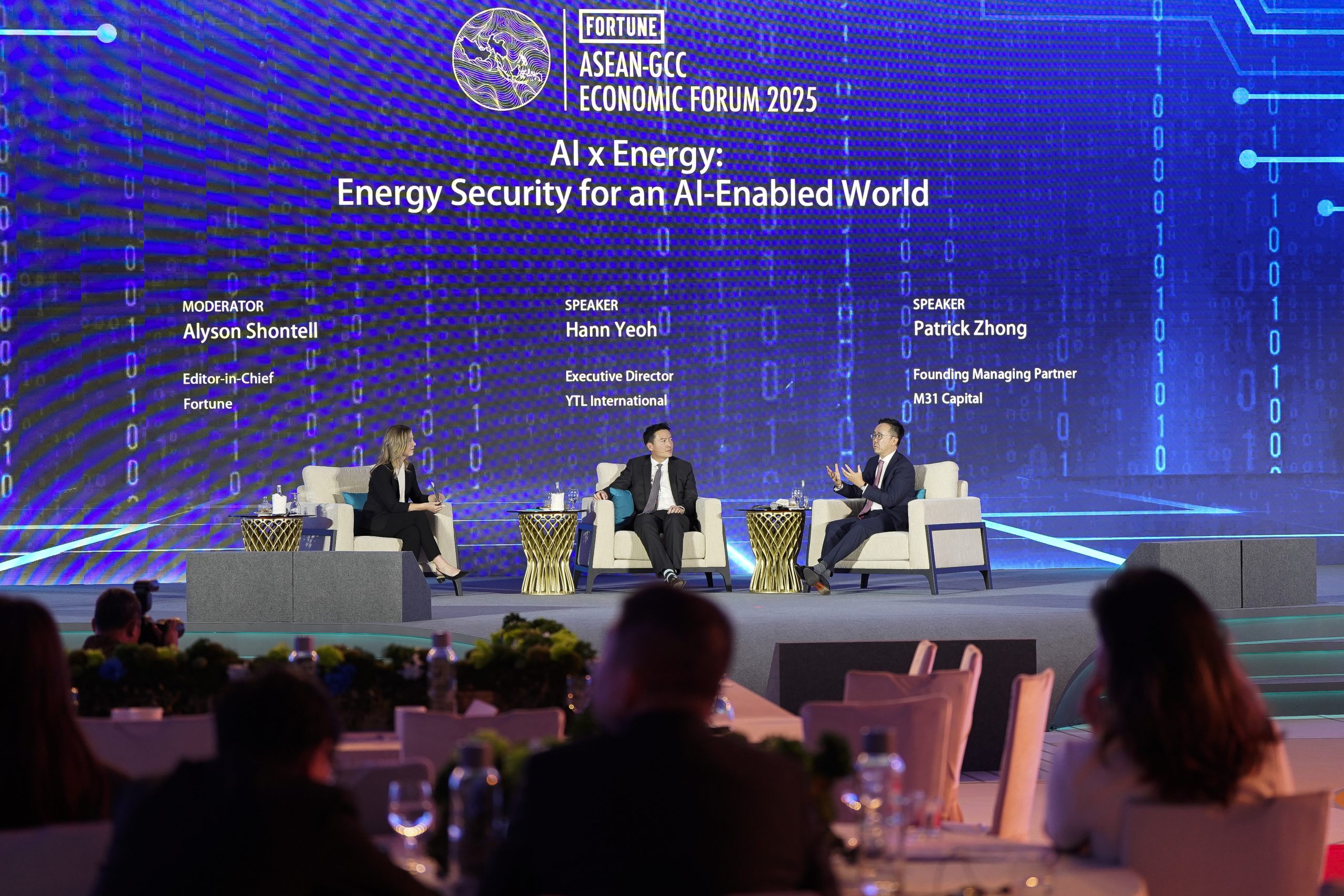

At the economic forum, Patrick Zhong outlined how AI is driving structural shifts in global energy markets—from demand forecasting and grid optimisation to capital formation in frontier technologies. He highlighted how the convergence of computational power and resource systems is altering investment theses, policy frameworks and industrial strategies across regions. The session was carried in full by Fortune.

Bank of America Asia-Pacific Breakthrough Technology Dialogue, Singapore — Earlier this year, Bank of America chose Singapore for its inaugural deep-tech forum on Sentosa, convening senior investors and policy leaders including Bernard Mensah, President of Bank of America International; Beh Swan Gin, Permanent Secretary at Singapore’s Ministry of Trade and Industry; Lim Chow Kiat, Chief Executive Officer of GIC; Jeffrey Jaensubhakij, Chief Investment Officer of GIC; Hermann Hauser, Co-founder of Amadeus Capital; and Don Vieira, Partner at Sequoia Capital. Discussions ranged from AI and quantum computing to biopharma’s next wave, with a shared focus on positioning capital for off-consensus breakthroughs before valuations catch up.

From markets where capital no longer moves in straight lines, clarity comes from proximity—not consensus. Across markets, Patrick Zhong brought a vantage point rooted in movement—of capital, ideas and institutional trust—helping entrepreneurs and decision-makers identify asymmetric market dynamics, build globally integrated ecosystems by aligning capital, knowledge and networks, reframe risk–return under non-linear pressures, and recognise directional shifts early to position where capital was moving—before narratives converged.